An Antidote to the Dialectical Gaussian

Cleveland Cliffs shows the benefits of thinking differently.

Over the years, I’ve observed the “success” of higher education in influencing the way I think and act. Indeed, I’ve observed it in my peers and across society. We live in the world of the Dialectical Gaussian.

The Dialectical Gaussian believes in exploring both sides of an idea, laying out the evidence, and coming to the conclusion that the answer lies in the middle. It’s the consequence of long years at university where the study of statistics is mandatory, and essays amount to literature reviews.

Nicholas Nassim Taleb has done a good job in highlighting the problems with a Gaussian framework; particularly, managing the risks that result from tail-outcomes. But it remains the case that moderns are most comfortable operating on the basis that the average outcome will always occur.

The dialectical method is harder to break (personally, I feel like I am cheating when I don’t present both sides of the story). Undoubtedly, there is value in considering both sides of the story. But there are downsides, too; no singular focus on the best or most likely outcome, and an inability to consider less likely outcomes, both positive and negative. The work required to consider both sides limits our ability to think expansively. It’s characterised by the cry “Do you have a source for that?”.

Lourenco Gonsalves, the CEO of US based integrated steel-maker Cleveland Cliffs, is the antidote to the Dialectical Gaussian. Goncalves is a rhetorician. He has a view and he shares that, specific, view. His quarterly earnings calls are known for bombastic language, analyst shakedowns and a clear-eyed view of his industry. Consequently, there’s a genius to Goncalves that is rare, particularly outside of technology.

In the last decade, his rhetorical lamentations for the seaborn iron ore market, likely resulted in a more disciplined supply environment. He would regularly accuse the large Australian iron ore miners of stupidity for aggressively bringing new supply. His directness has influenced the steady supply growth of this cycle.

Similarly, his willingness to see alternative outcomes has led to him re-shaping the steel industry in North America. Over eight years he has consolidated the company, exited the Australian iron ore business, built the first HBI plant in North America and integrated a number of steel and scrap businesses into Cleveland Cliffs. His willingness to think freely, and focus on one outcome, rather than many, has led to the creation of an amazing business.

Consolidated US steel industry.

The war in Ukraine is the latest example. Goncalves recognised a reliance on pig iron from Russia and Ukraine and the need to create more environmentally sustainable steel. By building an HBI plant in Toledo, Goncalves was able to create an analogous product to pig iron, with lower emissions, perfect for the Electric Arc Furnace market. Today, Cleveland Cliffs can provide HBI into the EAF market at a cost of $200/t, compared to $1000/t for imported pig iron.

The extent of Ukrainian and Russian exports into the US.

Each of these examples reflect a long-held Goncalves belief in “de-globalisation” that was evident in his statements going back to 2014. It is clear thinking that leads to a focus on a singular outcome and the execution of appropriate actions.

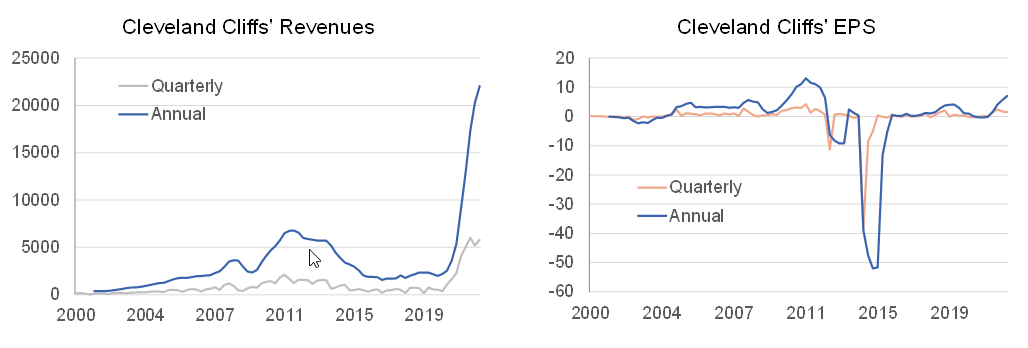

In the last quarter, Cleveland Cliffs saw an improvement in conditions, particularly in the last two months. The improvement reflected a clearing of finished steel inventories at customers. They expect automotive demand to rise as automobile inventories have cleared through 2021.

Updated Cleveland Cliffs Financials.

Auto Industry Inventories show a big improvement.

From an investment perspective, Cleveland Cliffs has been a great story. The gains over 2020 and 2021 likely provide the market with a period of further digestion. But ultimately, a more productive business, stable to better end markets, and a greatly improved balance sheet will support a higher valuation for Goncalves’ vision. From a personal perspective, I will endeavour to cast the dialectical gaussianism to the side.