Lennar uses DuPont to re-shape market

Lennar is re-shaping demand, via DuPont, in its market and offers an example of what will happen in the broader economy.

The second to last newsletter discussed the outlook for US housing. It described the challenge as “untangling knots”. The simple idea, explained verbosely, was that the US housing market has been tied up in knots by the large change in interest rates. It argued for a period of muddle through before it returned to a more normal environment.

The market’s pricing of the sector, however, suggested a solution had been identified. In Lennar’s quarterly earnings, the solution was presented. It’s worth considering.

DuPont Analysis

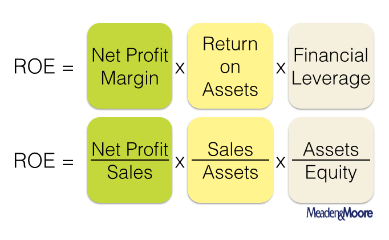

Before starting, here’s an overview of the DuPont framework. The DuPont analysis began with, the DuPont Chemical company, and is a means of thinking about Return on Equity (ROE) at a more granular level.

The constituent parts of the equation are laid out below. A company, generally, is balancing its profit margins (the price it sells its goods or services) with its asset turnover (how fast it makes sales). There is, typically, an inverse relationship between selling price and quantum of sales.

Lennar’s DuPont

Currently, Lennar’s DuPont looks like this:

ROE = Net Profit Margin x Return on Assets x Financial Leverage:

19% = 13.7% x 0.89 x 1.56

This puts Lennar at approximately the average ROE for the S&P 500. Importantly, Lennar trades at a 60% discount to the S&P 500. There is an opportunity for investors if the company can control the extent of the fall in ROE.

Lennar’s Strategy

In its most recent earnings call, Lennar outlined its strategy to protect ROE over the short, and medium-term.

First, the company is comfortable lowering its gross margin to sell homes. It has used software and yield pricing, similar to airlines, to price homes aggressively. It has also changed the price of its backlog to lower the cancellation rate. Since October, the cancellation rate has fallen two percentage points. While it has seen a 15% decline in sales, relative to the prior year, it now believes activity will be flat in 2023. In 2021, the company delivered 53,000 homes, 66,400 this year, and the expectations is for around 68,000 in 2023.

The loss in gross margin through lower prices, may not impact its asset turnover.

Second, the company is using its ability to maintain volume to put pressure on its supply chain. To quote CEO Rick Beckwitt:

Lennar led the way with reduction in margin while maintaining volume and increasing market share as the market has corrected. We expect our trade partners to work side by side with us and follow suit. As margins expanded in the best of times, they benefited. And as margins have now contracted in the more difficult times, we are driving costs down as prices are reduced, and we expect participation as well.

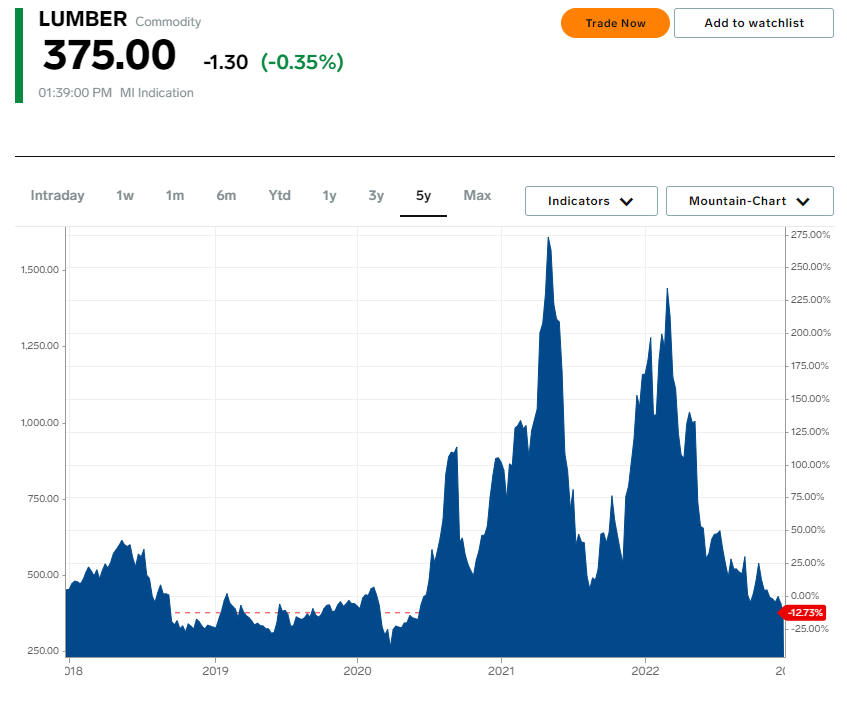

The other side of gross margin protection through lower costs will come from declining inflation. For instance, lumber prices will be very supportive of home builder margins in 2023.

Third, the company has aggressively looked at its spending on new land.

We started the quarter with $2.5 billion of expected land closings. We ended the quarter with three quarters of that spend, either walked from, renegotiated to produce a responsible margin, or pushed for reconsideration at a later time.

Again, this is protecting the gross margin from the cost side.

The final parts of the strategy are to maintain sales and marketing costs at efficient levels, manage with lower inventory, and increase cash flow.

The Outlook

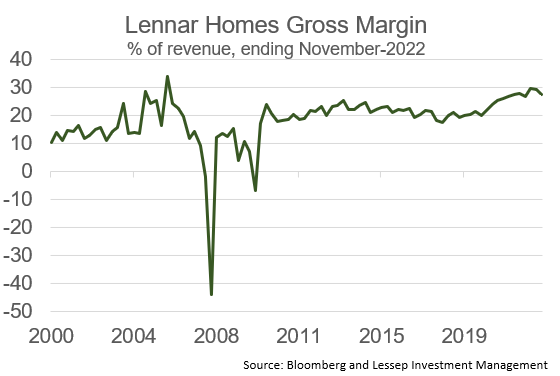

Lennar is happy to give up some price to maintain asset turnover. It believes that improvements in the supply chain, particularly a normalisation of lumber, will help cushion the blow to gross margin and profitability. It does have some margin to give up. From the pandemic, Lennar’s margin has expanded from close to 20% to nearly 30%.

Lennar is forecasting a gross margin of 21% in the first quarter of 2023. It believes:

… our first quarter closings to between 12,000 and 13,500 homes with a gross margin of approximately 21%, which we believe will be the lowest gross margin for the year. Additionally, we're targeting delivery volume to be flattish for the full year as we drive volume and pick up market share and build margin through reconciliation of construction costs and land costs and adjustment to product efficiency while carefully managing SG&A.

There are a number of moving pieces to this puzzle. But if the hit can be limited to gross margin, they’ve proved this to be the case already, then with stable sales and less accumulation of land, and greater accumulation of cash, Lennar could be a ~15% ROE business in 2023. Again, that’s not bad for its current valuation.

The Broader Macro

Lennar have offered some commentary on its markets. It has highlighted that there are three broad market groups. The first offers limited incentives, the second offers more aggressive incentives, and the third is in correction and has had to be re-priced lower.

Group One: southwest Florida, southeast Florida, Tampa, Palm Atlantic, New Jersey, Charlotte, Indianapolis, and San Diego.

Group Two (limited inventory but more aggressive financing): Jacksonville, Ocala, Atlanta, Coastal Carolinas, Raleigh, Virginia, Maryland, the Philadelphia metro area, Chicago, Minnesota, Nashville, Dallas, Houston, San Antonio, Colorado, Tucson, Las Vegas, California Coastal, the Inland Empire, the Bay Area, Central Valley, Sacramento, Seattle, and Boise.

Group Three: Orlando, Pensacola, Northern Alabama, Austin, Phoenix, Utah, Reno, and Portland.

In the second group, markets have seen an adjustment in price and incentives, and that has been sufficient to drive an improved momentum in sales.

When this investing environment is considered, relative to the 70s, this kind of corporate response is rarely considered. Companies today have the scale, a favourable competitive environment (created via mergers), and the information, to assist the economy to adjust considerably faster to changes in the macro-economic environment. This is just one example of a company that is pro-actively re-shaping its market to the benefit of shareholders, and the broader economy.