Suburbia Megatrend Entry Point

Improving household productivity is the driving force behind strong home demand in the United States.

The Lessep investment process was based on the idea that structural megatrends offer investors the best long-term opportunities. The investment process uses productivity as a leitmotif for the identification of these opportunities. If activity is occurring because it is productive, it becomes a sustainable and profitable trend.

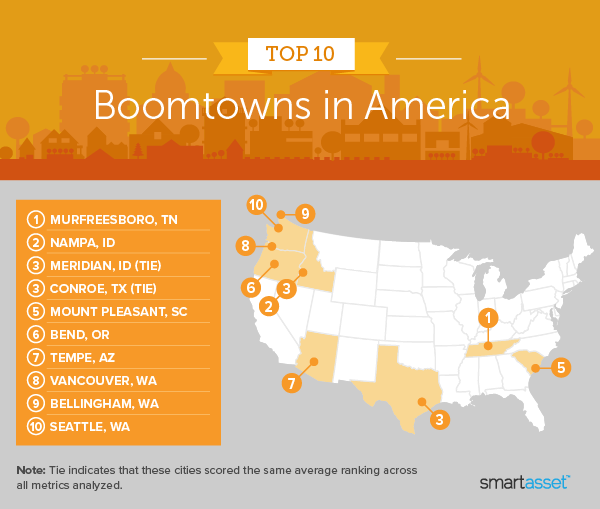

An early example of this was Suburbia. The Suburbia Megatrend reflects the shift in American demographics from dense urban and suburban areas around large cities, to less dense cities and suburbs in regional areas. It might be summed up as short New York and long Florida.

These demographic shifts reflect push and pull factors that improve the productivity of migrating households. Households in the traditional big cities and surrounding suburbs, Chicago, New York and Boston, are faced with higher taxes, longer commutes, crowded infrastructure and higher crime rates. By contrast, migrating households are moving to lower tax, less dense, states with less crime. In addition, the strength of demand for service sector jobs and work from home opportunities means incomes remain relatively high. Cities were emptying before Covid. Covid has accelerated the trend.

According to smartasset, Murfreesboro, Tennessee, is the fastest growing “Boomtown” in America. Its population has grown 20% in the last five years, housing units have increased 21%, unemployment is 3.4% and household incomes are up 38%. Households moving to Murfreesboro are improving their productivity. It’s typical of smaller cities across America.

This stands in contrast to the unproductive dynamics at play during the sub-prime boom. First, real wages were weak between 2002 and 2007. Second, new home-buyers were moving from dense cities to the suburbs of Phoenix and Las Vegas with higher home maintenance costs (pools, air-conditioning) and longer, more expensive (no public transport) commutes. It was a costly enterprise. The change in interest rates was the straw that broke the camel’s back.

Today, the migration is generating productivity improvements. The job opportunities are considerably greater. Households can either maintain a Work-From-Home role or find high-value service sector roles, such as law, medicine and accounting, as increasing populations boost demand. For professionals, wage growth through the pandemic has been stable and savings have boomed.

Further, the house price differentials are considerable. A lawyer could sell in Bridgeport, Connecticut ($460,000 average house price), to practice in Durham, North Carolina ($272,000). A New York ($450,000) financier paying 6.85% state income tax could move to no personal income tax Miami ($302,000). A tech bro could leave San Jose ($1,160,000) and WFH in Boise, Idaho ($290,000).

Across all but one variable, interest rates, the financial and well-being benefits of migrating internally within the United States are substantial. Since 2021, 30-year mortgage rates are up 60%. Undoubtedly, higher fixed mortgage rates will dampen demand for mortgages, particularly re-mortgages, and slow internal migration but the underlying economics remain strong.

Consequently, the peak in 30-year mortgage rates reflects a good entry point into the best exposure to Suburbia, the home-builders. As the Federal Reserve begins the process of raising rates this month, the market will get clarity around medium-term strategy and the likely impact of higher short-term rates. This should see long-term rates pause and drive better home-builder performance.

The home-builders have reported solid earnings through Q1 2022. America’s largest builder, DR Horton, beat estimates on solid volumes and higher home prices. They are slowing down the pace of building and sales as inflationary pressures bite but expect 25% sales growth this year. Interestingly, DR Horton’s cancellation rate was 1% in the quarter. Historically, this has been as high as 30%. From their perspective, any buyers they may lose to high mortgage rates are easily replaced.

There is a risk that US housing is, currently, at the peak of its cycle. It’s also risky buying commodity producers on low valuations. A high quality builder like DR Horton trades on 5.1x this years EPS, while Meritage Homes is trading on 3.9x. More likely, its an inflection or pause as the market digests higher rates. As DR Horton is arguing, demand is solid, and importantly the supply side looks disciplined. Further, these companies have the balance sheet to support a period of digestion.

It’s our view that the current price level for housing, represented by the XHB ETF, is an attractive entry point for this Megatrend.