The Trade Desk: Replacing Meta and Google

The Trade Desk is positioned to operate in the same markets as Facebook and Google, without the baggage.

Meta and Alphabet (Google parent), two of the original members of the FAANG1 stock group, have hit upon hard times. This reflects a combination of lower, more cyclical growth in platform advertising, on-going regulatory issues, and increasing battles over content. There may be a strong valuation case for both stocks, but from a growth perspective, it seems, their time has passed.

Results

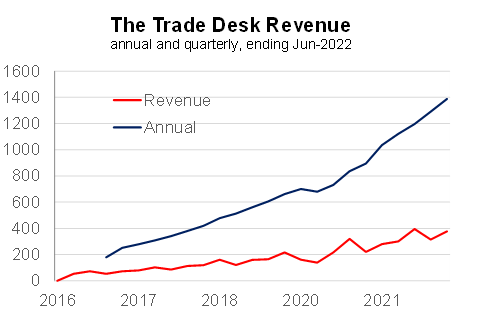

The Trade Desk operates as a buy-side market place for advertising inventory. It creates a market for advertising inventory from internet sites, particularly connected television (CTV), and sells it to advertisers. It benefits from the targeted nature of its ads, the growth in CTV, and its approach to anonymity. The latest round of results pushed a 37% increase in the stock price over the week.

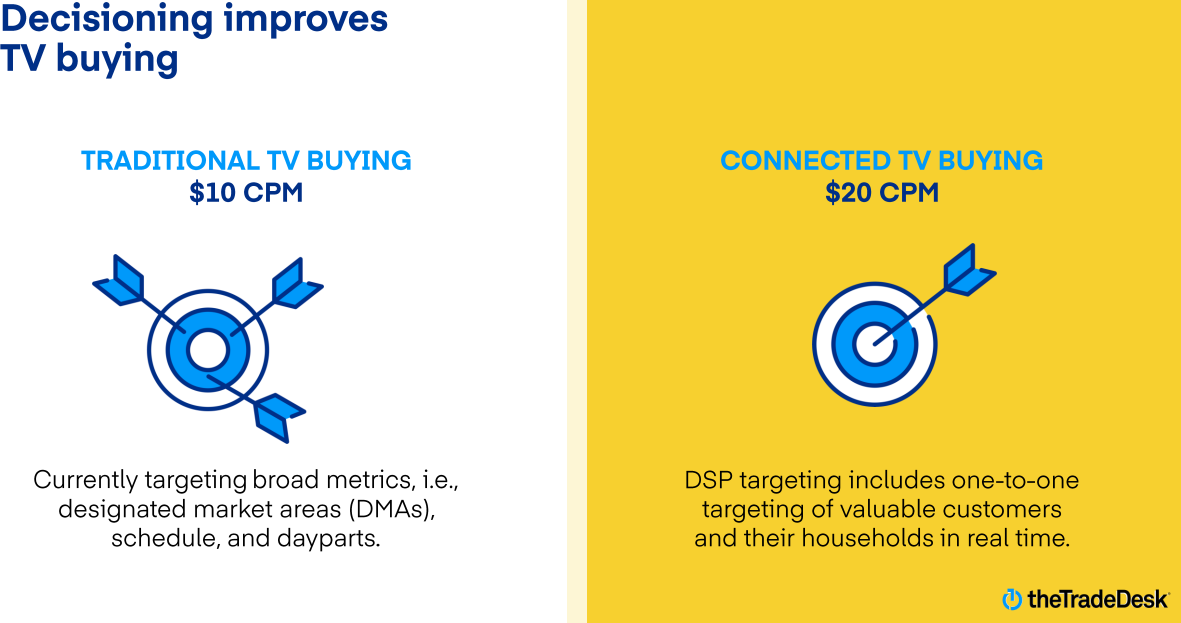

The value of The Trade Desk, and its key CTV market, is demonstrated in the graphic below. The Trade Desk gains, for the inventory owner, double the price for CTV ads2, relative to normal TV, based on the granular targeting of its platform.

Strategic Value: A Better Bet than Meta and Alphabet

There are a number of reasons why The Trade Desk has a brighter future than Meta and Alphabet.

Growth: The growth profile for CTV advertising is faster than the growth profile for online advertising. Over the last decade, online advertising has increased at an annual rate of 18%. Outside of election cycle years, online advertising growth is low double digit, and becoming more cyclical. From 2019, CTV ad spend has increased 43% per annum, and is expected to grow at 20% to 2025.

Quality: The quality of a CTV ad is higher, from an advertiser’s perspective. Online advertising, ads that pop up on a page, or in a search, are easily forgotten or ignored. A CTV ad, where the ad has interrupted a favourite show, at an exciting moment, is not easily ignored. This is a high quality opportunity to influence a targeted consumer.

Regulation: At this stage, there are no obvious regulatory problems for The Trade Desk. It’s an automated version of something that existed before, media buyers. Indeed, The Trade Desk’s anonymity focus, through UID, is aimed at pre-emptively creating the best regulatory environment for the company.

Anonymity. It’s a lot easier to avoid regulatory scrutiny, and prepare the regulatory framework, when the company is unknown to consumers (voters).

Content: The Trade Desk does not own the content in which it places ads. The content owner moderates the content, such as Netflix, ESPN, News Corp, etc. not The Trade Desk. YouTube, Instagram, Twitter, on the other hand need to moderate their users’ content, at a high cost.

Independence: CEO Jeff Green outlined this argument, specific to Google, in the latest earnings call. “They have run marketplaces with questionable integrity and fairness, but they win advertising budgets because of their dominant position and their size and footprint around the world. CTV will change that …”

Optionality. The Trade Desk has some optionality in regards to future growth. First, it is winning market share, as evidenced in the latest earnings. Second, it has not yet integrated Netflix into the eco-system. Netflix is 26% of all CTV viewing. Finally, it likely has an ability, with increasingly targeted options, to expand the scale and scope of advertisers prepared to bid for CTV ad inventory. This would increase price per CPM and has been an important growth driver for Google and Meta.

A selection of media companies that sell ad inventory through The Trade Desk’s platform.

Valuation

The big challenge for investors is understanding whether, at $36 billion market capitalisation, there is sufficient opportunity in The Trade Desk. At 26x Price to Sales, it is expensive, in the context of the market, and relative to its own history.

The two mitigating factors are profitability and long-term growth.

The Trade Desk has a higher gross margin at 81%, than either Meta (80%) or Alphabet (57%). From a long-term perspective, it’s the belief at Lessep that high gross margin will, over time, translate to high net income margin.

Long-term revenue growth forecasts are necessarily vague. But the premise of this newsletter is that The Trade Desk is the next Meta or Alphabet. Alphabet has grown revenue 24% per annum since 2006 and Meta has grown revenue 43% per annum since it listed in 2014. If The Trade Desk captures its market opportunity, it will enjoy similar, long-term, revenue growth.

Conclusion

It’s easy to be positive a stock that has had a rapid, one-week appreciation. It’s likely to give back some of its gains in coming weeks. But overall, The Trade Desk has a unique opportunity to become a dominant player in a key global growth sector over the next decade and will remain one of the largest Lessep holdings.

Facebook, Amazon / Apple, Netflix, Google,

This is measured in CPM, cost per thousand (mille) views.